For most of my life, I just knew that a Roth IRA was better than a Traditional IRA. It was a given, no work needed to be done on this one. That was until one afternoon during grad school when a professor challenged my belief, so I challenged his and he performed an exercise similar to the one I will work through later.

A Roth IRA is a retirement investment account in which the investor is not permitted by the IRS to deduct contributions to the account. That is to say, that this account is funded entirely with post-tax dollars – money you already earned and paid tax on similar to a savings account. The attribute that always piqued my interest was that you can let this account earn returns for the rest of your life and you never have to pay tax in those earnings. I made it a point to fund my Roth as much as I could (and I still do) because of that great tax benefit in the future. There are income restrictions limiting only people that have a modified adjusted gross income under $105,000 to participate. An investor is also limited to $5,000 per year for either a Roth IRA or a Traditional IRA (or both).

A Traditional IRA permits investors to contribute pre-tax dollars to fund the account. So you can take the amount you invested into the Traditional IRA off of your income for the year in which you contribute the cash – similar to a 401k plan. The investor will then have to pay a tax bill we he/she cashes in the account to retire.

The Exercise

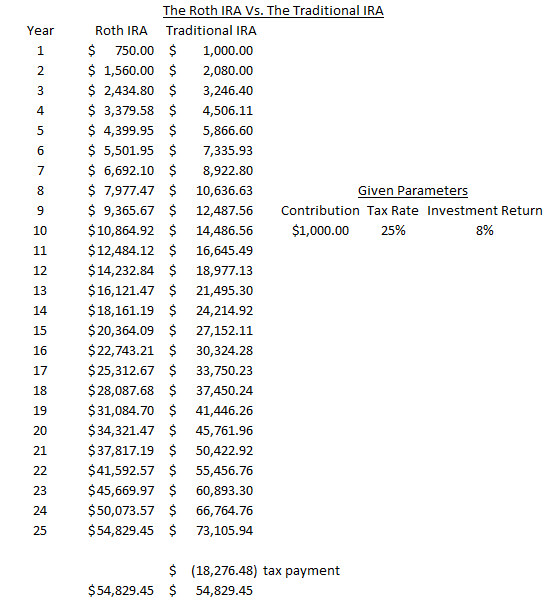

The spreadsheet below details two scenarios with the same given parameters. The given parameters are:

- A 25% tax rate for the entire 25 years of the exercise.

- An average 8% return on the investments for the entire 25 years.

- A steady $1,000 yearly contribution for the Traditional IRA as this is pre-tax.

- A $750 yearly contribution for the Roth IRA as you need to first pay tax on it.

The Results

As you can see from the bottom line result, given the exact same parameters, you will realize the exact same result from either IRA. A draw. I was shocked at these results even though it made sense when it was all said and done. So what is the point of the Roth IRA anyway? Well, the key to deciding how to pick an IRA comes down to your current tax rate and the expected tax rate in the future.

It Comes Down to Taxes

You do not need to hire a CPA to figure out your current tax rate. You may want to hire a psychic to figure out your future tax rate – and the psychic may even be challenged to predict future congressional actions. Common wisdom may predict that your tax rate in retirement may be less than it is as a working professional. In this case it would be better to pay the tax at that time and at your lower rate – you would pick the Traditional IRA. Others may argue that the government will be raising tax rates to pay for a national debt that is spiraling out of control, underfunded social security and national healthcare system. A subscriber to this logical path should invest in a Roth IRA and pay the taxes now.

This article should be called “the tax rate now vs. the tax rate in the future” instead of “Roth vs. Traditional” because your prediction of the future tax rates should drive this decision. If you asked ten people what they thought, you would get ten different answers. The bottom line is that no one knows what the future holds. Just like all other aspects of investing, it is prudent to not put all your eggs in one basket and instead spread your bets around. I have a Roth IRA and a Traditional IRA. Contributions vary based on other retirement accounts I am contributing to at that time. I try to always be contributing to my Roth and a tax deferred account whether it be a Traditional IRA or a 401k and you should to.

Tags: 401k, Retirement, Roth-IRA, Traditional IRA